I Hope You Take HDFC Home Loan 2024

Introduction:

Few decisions in financial planning rival the importance of buying a home. For many, it represents the culmination of lifelong dreams and desires. However, the process of acquiring housing often requires financial assistance in the form of housing loans. Among the leading providers of such financial solutions is HDFC, renowned for its reliability and customer-centric approach. In this comprehensive guide, we delve into the intricacies of HDFC Home Loans and cover key aspects like eligibility criteria, interest rates, EMIs, customer support and more. Whether you are a prospective home owner or just looking to refinance, understanding the dynamics of HDFC Home Loans is paramount.

HDFC Home Loans Explained:

HDFC or Housing Development Finance Corporation Limited is one of India’s leading housing finance companies. With a rich heritage spanning decades, HDFC has earned trust and credibility among millions of customers across the country. Its suite of home loan products caters to a variety of needs, from buying a new home to renovating an existing property or building from scratch.

HDFC Home Loan Products:

HDFC offers a range of home loan products tailored to suit different requirements: Home Loan: Designed for individuals who wish to purchase a new residential property.

Home Improvement Loan: Aimed at financing renovation projects or renovations of existing properties.

House construction loan: Provides financial support for the construction of a new house on a plot of land.

Home Extension Loan: Facilitates the extension of an existing property by adding additional space.

Land Loans: Offers financing for the purchase of land or residential land.

HDFC Home Loan Eligibility:

In order to avail the HDFC Home Loan, applicants must fulfill certain eligibility criteria including: Age: Usually between 21 and 65 years, although it may vary depending on the profile of the applicant.

Income: A stable source of income demonstrating ability to repay.

Employment: Salaried individuals or self-employed professionals/business owners are eligible.

Credit: A good credit score increases the chances of loan approval.

Property Valuation: The property to be purchased or constructed must meet HDFC valuation standards.

Browse HDFC Home Loan Features:

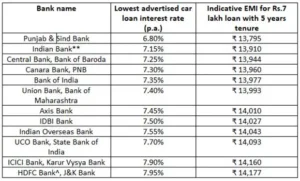

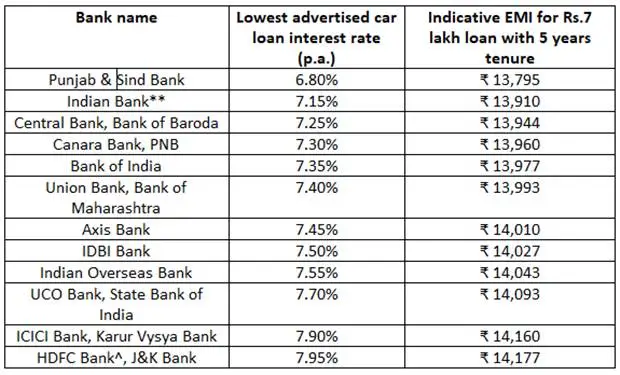

HDFC Home Loan Interest Rates:

Interest rates play a key role in determining the availability of a home loan. HDFC offers competitive interest rates which may vary depending on factors such as loan amount, tenure and prevailing market conditions. It is advisable to keep up-to-date with HDFC home loan interest rate trends as even slight fluctuations can affect long-term repayment obligations.

In particular, the HDFC Home Loan Interest Rate 2023 has witnessed stability amid economic fluctuations, providing borrowers with a sense of predictability and security.

HDFC Home Loan EMI Calculator:

Calculating Equated Monthly Installments (EMIs) is essential for assessing repayment capacity and financial planning accordingly. HDFC provides an online EMI calculator tool that allows borrowers to estimate their monthly repayment obligations based on the loan amount, tenure and interest rate. This allows borrowers to make informed decisions and choose a repayment structure that is consistent with their budget constraints.

HDFC Home Loan Billing:

Regularly monitoring your credit statements is essential to stay on top of payment schedules, outstanding balances, and other related details. HDFC offers a convenient online portal where customers can easily access their home loan statements. These statements provide a comprehensive overview of the loan account and enable transparency and accountability throughout the repayment period.

Hassle Free HDFC Home Loan Application Process:

Applying for an HDFC Home Loan is a streamlined process that aims to minimize hassle and maximize convenience for customers. The steps usually include:

Pre-application documentation: Gather essential documents such as proof of identity, proof of address, income statements and proof of assets.

Online Application: Using HDFC’s digital platforms to securely submit the application form and necessary documents.

Verification and Approval: HDFC’s rigorous verification process ensures the authenticity of the information provided before granting loan approval.

Disbursement: Once approved, the approved loan amount is disbursed immediately, allowing borrowers to begin their home buying journey without delay.

Access HDFC Home Loan Services:

HDFC Home Loan Application:

HDFC’s online portal serves as a centralized hub for customers to manage their home loan accounts efficiently. After logging into their HDFC home loan accounts, customers can perform various tasks including:

Check your account balance and transaction history.

Making EMI payments securely.

Viewing and downloading credit statements.

Updating contact information and communication preferences.

Ask a customer support representative for help.

The HDFC Home Loan login interface prioritizes user-friendliness and security, ensuring a seamless digital banking experience for customers.

HDFC Home Loan Customer Care:

Exceptional customer service forms the cornerstone of HDFC’s ethos, with dedicated support channels to cater to various queries and concerns. Whether borrowers need assistance with loan application procedures, repayment schedules or complaint resolution, HDFC’s customer care team is readily available through various communication channels, including phone, email and online chat.

Chack Sbi Car Loan Interest Rate 2024

Conclusion:

HDFC Home Loans essentially epitomize accessibility, affordability and reliability, enabling countless individuals to realize their home ownership aspirations. From competitive interest rates and flexible repayment options to a robust customer support infrastructure, HDFC remains the preferred choice for discerning home buyers across India. By demystifying the complexities of HDFC Home Loans and harnessing the power of digital platforms, prospective homeowners can embark on their property ownership journey with confidence and peace of mind.

+ There are no comments

Add yours