Chack Sbi Car Loan Interest Rate 2024

Introduction

In today’s fast-paced world, owning a car has become a necessity rather than a luxury. As the demand for cars increased, so did the need for car loans. Among the plethora of options available in the market, State Bank of India (SBI) and HDFC Bank stand out as prominent players offering competitive interest rates on car loans. In this comprehensive guide, we delve into the intricacies of car loans with a focus on SBI and HDFC interest rates, equipping you with the knowledge to make informed decisions.

Understanding Car Loans

Car loans are financial products designed to help individuals purchase a vehicle without having to pay the full amount up front. Instead, the borrower repays the loan amount over a set period of time, including interest, making it more manageable to afford a car. Several factors come into play when considering a car loan, with interest rates being one of the most important aspects.

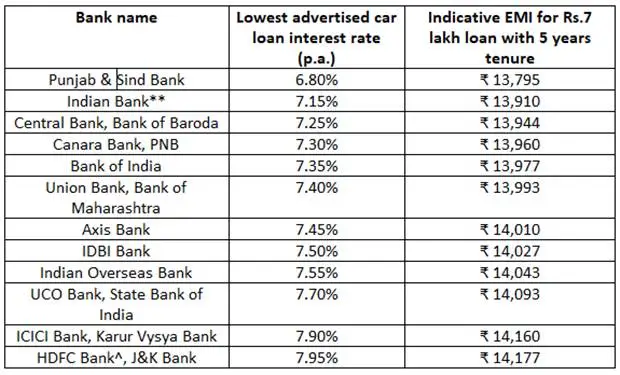

SBI Car Loan Interest Rates

State Bank of India, which is one of the largest public sector banks in India, offers attractive interest rates on car loans. Interest rates can vary depending on many factors, such as the borrower’s credit rating, loan amount, tenure and type of car being financed. Let’s explore the various aspects of SBI car loan interest rates:

- SBI Car Loan Interest Rate: The interest rates offered by SBI are competitive and cater to a wide range of borrowers. As of 2023, SBI’s car loan interest rates have been among the most competitive in the market, making it the preferred choice for many potential car buyers.

- SBI Car Loan Interest Rate Calculator: SBI provides a user-friendly online calculator that allows borrowers to estimate their monthly repayments based on the loan amount, tenure and interest rate. This tool enables borrowers to effectively plan their finances and choose a loan scheme that suits their budget.

- SBI Car Loan Interest Rate for Government Employees: SBI recognizes the unique needs of government employees and offers special interest rates tailored to their requirements. These concessional rates make car ownership more affordable and affordable for government employees, facilitating their mobility.

- SBI Car Loan Interest Rate Today: Interest rates are subject to change based on market conditions and internal policies. Borrowers can check the current interest rates on the SBI website or contact their nearest branch for the most up-to-date information.

HDFC Car Loan Interest Rates

HDFC Bank, a leading private sector bank in India, also provides competitive interest rates on car loans, attracting significant market share. Understanding HDFC interest rates is essential for borrowers looking for flexible and affordable financing options. Here’s what you need to know:

HDFC Car Loan Interest Rate: HDFC offers competitive interest rates on car loans, making it an attractive option for borrowers across segments. Interest rates may vary depending on factors such as loan amount, term and borrower’s credit profile.

HDFC Car Loan Interest Rates Comparison: Before committing to a car loan, it is essential to compare HDFC’s interest rates with those of other lenders to ensure you are getting the best deal. Doing thorough research and understanding the terms can help you make an informed decision.

Special offers and discounts: HDFC often introduces special offers and discounts on car loans, especially during holidays or promotional periods. These incentives may include lower interest rates, processing fee waivers, or cashback offers that provide additional savings for borrowers.

Comparative Analysis: SBI Car Loan Interest Rates Vs. HDFC

Both SBI and HDFC offer competitive interest rates and a range of features to cater to different customer needs. However, there are some differences between the two that borrowers should consider:

Accessibility: SBI, being a public sector bank, has a vast branch network across the country, making it easily accessible to borrowers in both urban and rural areas. HDFC as a private sector bank may have a more concentrated presence in urban centres.

Customer Service: While both banks prioritize customer satisfaction, the quality of service may vary depending on individual experience and branch location. Borrowers should consider factors such as responsiveness, transparency and after-sales support when choosing a lender.

Flexibility of terms: HDFC can offer more flexibility in terms of loan tenure, repayment options and eligibility criteria as compared to SBI. Borrowers should assess their preferences and financial goals to determine which bank better suits their requirements.

How To Chack Car Loan Interest Rate In Mobile Phone 2024

Conclusion

In conclusion, car loans are a tool to fulfill the dream of owning a vehicle and provide individuals with the flexibility to purchase a car without the financial burden. When considering a car loan, understanding the interest rates offered by lenders like SBI and HDFC is essential for making an informed decision. By using tools like interest rate calculators and loan scheme comparisons, borrowers can navigate the complexities of car financing and get on the road to car ownership with confidence. Whether you choose SBI or HDFC, careful consideration of interest rates and other terms can help you secure the best deal and enjoy the thrill of driving your dream car.Sbi Car Loan Interest Rate

In the dynamic environment of auto financing, staying informed and proactive is key to making sound financial decisions that align with your goals and aspirations.

+ There are no comments

Add yours